This company might be more familiar to you than you realize. If you’ve picked up a bag of SunRice products or rice crackers at Coles or Woolworths, you’ve already encountered it. Yet, this little-known ASX stock, Ricegrowers (ASX: SGLLV), has managed to fly under most investors’ radars. Part of the reason could be its 5-letter ticker symbol—uncommon for ASX stocks, which are typically three letters. But there’s another reason investors might want to take a closer look: SunRice shares have just hit an all-time high, and the fundamentals suggest there’s room for continued growth.

What makes Ricegrowers such an appealing investment? Let’s explore.

Snapshot of Ricegrowers (SGLLV) – “SunRice”

Ricegrowers Limited, known as SunRice, is a leading Australian food company with a strong international footprint. It processes, markets, and distributes a diverse array of rice products, including rice blends, rice cakes, and snacks. Its brand portfolio is most recognizable under the SunRice name, which has become a staple in Australian households.

One unique feature of Ricegrowers is its dual-class share structure. The A Class shares are held by rice growers and carry voting rights, while B Class shares—listed on the ASX under SGLLV—are held by regular shareholders, with rights to dividends but without voting power. This setup underscores the company’s agricultural roots and the strong ties it maintains with Australian farmers, making it a rare hybrid between a grower-owned co-op and a public company.

Ricegrowers operates across the following segments:

- Rice Pool: Primarily for domestic rice supplies.

- International Rice: Serving rice markets around the globe.

- Rice Food: Offering value-added rice products.

- Riviana Foods: A diversified food business with various consumer brands.

- CopRice: A segment specializing in animal nutrition.

Strong Performance Despite Limited Coverage

Since its listing, SGLLV shares have had a bumpy ride, initially facing a sharp dip before stabilizing and going sideways for the past couple of years. Recently, however, the stock has surged upward, reaching new all-time highs. This rise comes with little broker coverage, making it an under-the-radar success story in a challenging economic environment.

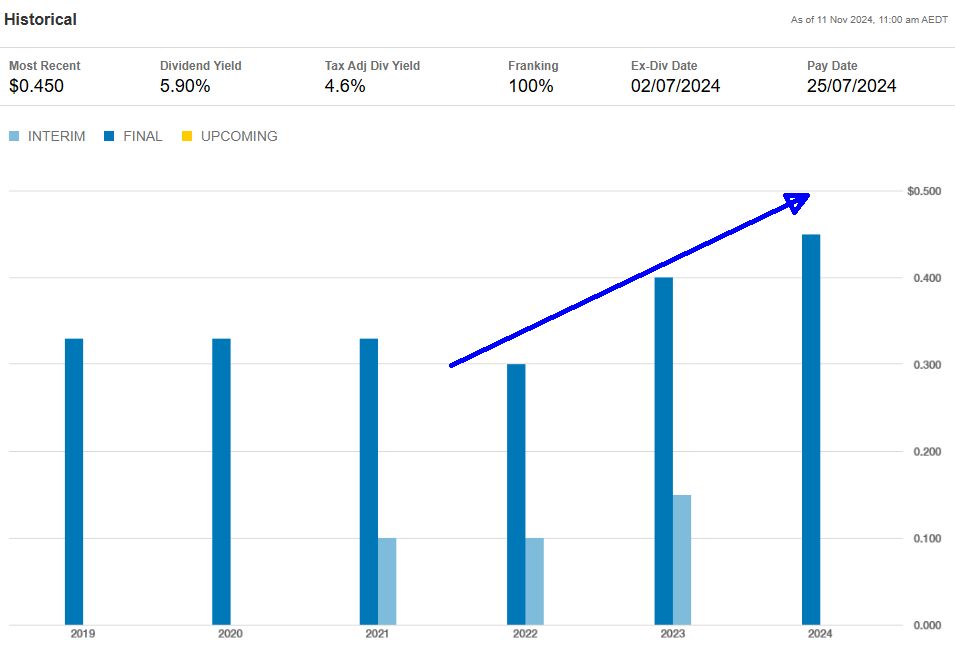

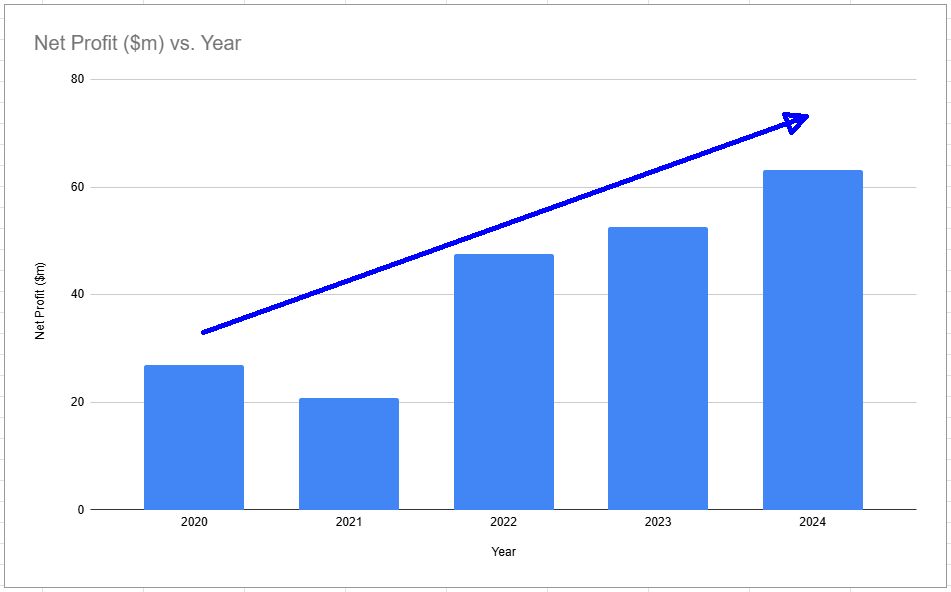

A major factor supporting this upward momentum is Ricegrowers’ strong fundamentals. Despite the stock’s recent high, its price-to-earnings (P/E) ratio remains modest at around 9, signalling that the valuation is not overextended. Moreover, the company offers an attractive dividend yield close to 5%, which has seen steady growth—something of a rarity in the food sector, where dividends are often modest or stagnant.

This balance between a low P/E ratio and a solid dividend yield highlights that the stock might still offer a compelling value proposition. Combined with rising revenue and profits, it’s a recipe that has the potential to keep rewarding investors.

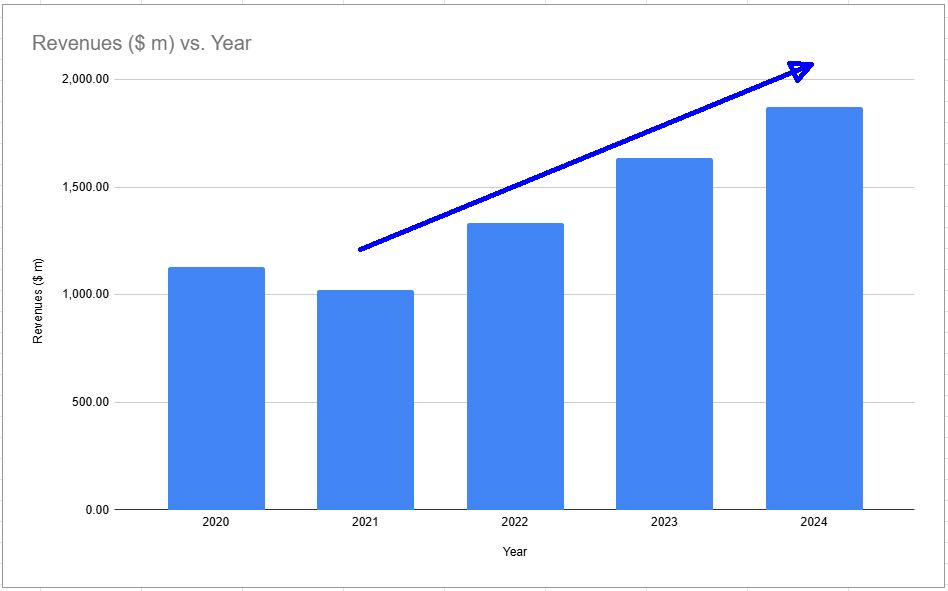

Rising Revenues and Profitability

Since its ASX listing, Ricegrowers has reported consistent growth in both revenue and net profit. The company has invested in expanding its international footprint, with an eye on diversified markets to mitigate any adverse impacts from domestic challenges. This strategy appears to be paying off, with recent reports indicating substantial growth across the International Rice and Rice Food segments.

For instance, Ricegrowers’ expansion into Southeast Asian markets has helped to offset any fluctuations in Australian rice production due to climate and water conditions. At the same time, the Riviana Foods and CopRice segments have contributed significantly to overall revenue, reflecting the company’s diversified approach.

This expansion has had tangible results on the bottom line, as evidenced by SunRice’s growing net profit. The charts show a steady rise in profitability, aligning well with revenue growth. And as Ricegrowers continues to establish itself in high-growth regions, it’s likely that revenue and profit figures could see even further upside.

What Analysts Are Saying

Despite its recent performance, Ricegrowers remains a stock that hasn’t captured much attention from brokers. However, the few who do follow it tend to rate it favourably. Given its solid financial performance, low P/E ratio, and appealing dividend yield, analysts remain bullish on SGLLV stock. This positive sentiment remains strong, even with the stock trading at an all-time high.

Some analysts believe that the stock’s valuation still has room to grow, especially if SunRice continues expanding its international presence. The relatively low market capitalization ($605m at the time of writing), compared to other food giants provides additional headroom for growth. Given the company’s brand strength and consistent performance, it seems plausible that Ricegrowers could emerge as a mid-cap contender within the ASX 200.

Risks to Consider

Investing in Ricegrowers does come with a few industry-specific risks. The company is exposed to agricultural risks, including climate variability and water availability, both of which can impact rice production. Moreover, fluctuations in global rice prices may affect profitability, especially if production costs rise while retail prices remain stable.

However, Ricegrowers has strategies to mitigate these risks, such as geographic diversification and developing higher-margin, value-added products. This approach has helped protect revenue streams and ensures that the company remains profitable even in the face of fluctuating production levels.

Is It Time to Buy?

Ricegrowers emerges as a compelling investment opportunity for those seeking exposure to a strong, recognizable brand with solid growth prospects. The company’s impressive rise to an all-time high reflects both market confidence and its effective business strategy.

Positioned as a rare find on the ASX, Ricegrowers offers stable returns, strong fundamentals, and despite limited analyst coverage, enjoys widespread consumer love. As this ASX-listed stock continues to climb, investors may wonder if it’s time to add this “hidden gem” to their portfolios.

With steady revenue growth, international expansion, and a secure dividend, Ricegrowers could be a valuable addition to a diversified portfolio. Its recent surge suggests further upside potential, and with strong fundamentals to support it, SGLLV may be poised for continued success. The current valuation, with a low P/E ratio and growing dividend yield, adds further appeal.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute financial advice. It is not intended to be a substitute for professional financial advice, and you should not rely solely on this information for your investment decisions. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. Aussie Bugger is not responsible for any financial losses or gains resulting from your investment choices. Remember, all investments carry risks, and past performance is not indicative of future results.

This piece lingers in the mind, sparking thoughts that stay with you long after you’ve finished reading.

You have the gift of turning abstract thoughts into something tangible, allowing the reader to grasp concepts with clarity.

Thank you for your thoughts.

Superb, what a blog it is! This web site gives valuable information to us, keep it up.