Since its launch in 2012, Selfwealth (ASX: SWF) has grown from a small startup to one of Australia’s popular brokerage platforms. Known for its flat-fee model, Selfwealth charges just $9.50 per trade regardless of trade size. This structure disrupts the traditional approach, where brokerage fees increase with trade value. In 2017, Selfwealth went public on the Australian Securities Exchange, enhancing transparency and building trust among its over 130,000 users. Today, with a new counter bid from Axi Financial, the competition to acquire Selfwealth is heating up, underscoring the platform’s appeal in today’s market.

Why Selfwealth Is an Attractive Target

Selfwealth has caught investors’ attention partly due to its recent expansion into international markets. Originally focused on flat-fee trading for Australian stocks, Selfwealth now enables clients to invest in U.S. and Hong Kong markets, offering Australians access to top global companies. For users, this means broader investment options without the typical high fees that come with international trades. With Selfwealth’s model, everyday investors can now diversify internationally as easily as they do with Australian stocks—an appealing feature for those looking to invest in global markets.

Selfwealth also offers a wide range of account types to fit different needs. What started with just individual accounts has grown to include options for joint, minor, company, trust, and SMSF (Self-Managed Super Fund) accounts. This flexibility makes it a practical choice for everyone—from young investors to those managing retirement portfolios. Additionally, Selfwealth’s refer-a-friend program offers free trades as a reward, further driving its growth by attracting users who want affordable, easy trading.

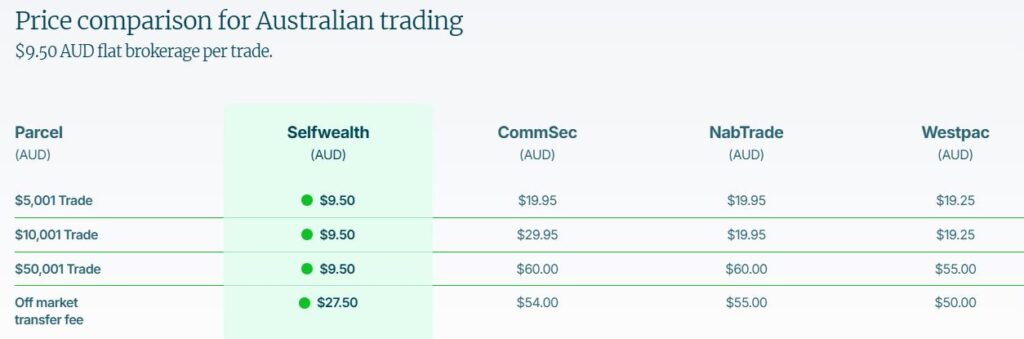

The platform’s simple, flat-rate pricing also sets it apart from other brokers. While many major brokers raise fees as trades get larger (up to $60 for high-value trades), Selfwealth’s $9.50 fee stays the same. This predictable cost structure is especially valuable for investors mindful of fees or who trade frequently, helping them keep more of their returns.

The Bidding War Heats Up

This week, the takeover battle for Selfwealth intensified when AxiCorp Financial Services (Axi) entered the scene with a bid of $0.23 per share. This all-cash offer slightly tops an earlier $0.22 per share bid from Bell Financial Group (asx: BFG), which gave Selfwealth shareholders a choice between cash or shares. Axi’s proposal values Selfwealth at about $53.1 million, a bit higher than Bell’s $51 million offer.

Founded in 2007 and based in Sydney, Axi is a global brokerage with a focus on forex and contracts for difference. Axi’s interest in Selfwealth seems to be high, as it has expressed readiness to finalize the deal if the Selfwealth Board recommends it. Axi’s proposal includes standard terms, such as requiring the Board’s endorsement and canceling existing performance rights, to pave the way for a smooth acquisition.

Initially, Selfwealth’s board favored Bell’s bid, calling it an appealing option for stakeholders. However, with Axi’s higher offer on the table, the board has paused its decision, advising shareholders to wait while negotiations unfold. This rivalry between Axi and Bell shows how valuable Selfwealth is as an acquisition, and it’s possible that the bidding war may draw additional offers from other interested buyers.

With both Axi and Bell competing to acquire Selfwealth, shareholders may see the company’s sale price rise even further. As these negotiations play out, Selfwealth’s commitment to transparency ensures that shareholders stay informed, offering them a sense of assurance as they watch this pivotal moment unfold in Australia’s brokerage industry.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute financial advice. It is not intended to be a substitute for professional financial advice, and you should not rely solely on this information for your investment decisions. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. Aussie Bugger is not responsible for any financial losses or gains resulting from your investment choices. Remember, all investments carry risks, and past performance is not indicative of future results.